-

Welcome to

Delta County

Appraisal District! -

-

-

-

-

Current News

Current News

View NewsTruth In Taxation

Truth In Taxation

View NowContact Information

-

1280 W Dallas Ave

Cooper, TX 75432 - (903) 395-4118

- (903) 395-4455

-

PO Box 47

Cooper, TX 75432 -

Interim Chief Appraiser

Jana Herrera, RPA, CCA -

Monday - Thursday

8:00am - 4:30pm

Friday

8:00am - 4:00pm

Our Mission

Tax Transparency

NOTICE OF ESTIMATED TAXES AND TAX RATE ADOPTION INFORMATION

Visit Texas.gov/propertytaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

You may also access the Delta site directly using the following link: https://delta.countytaxrates.com.

Property owners have the right to request the information from the assessor of each taxing unit for their property. You may request their contact information from your local Tax Assessor-Collector listed below.

Delta County TAC

Dawn Moody

200 W. Dallas Ave

Cooper, TX 75432

(903) 395-4400 Ext. 9317

THE COUNTY TAX ASSESSOR DOES NOT DETERMINE PROPERTY VALUES OR TAX RATES.

Welcome to Delta County Appraisal District

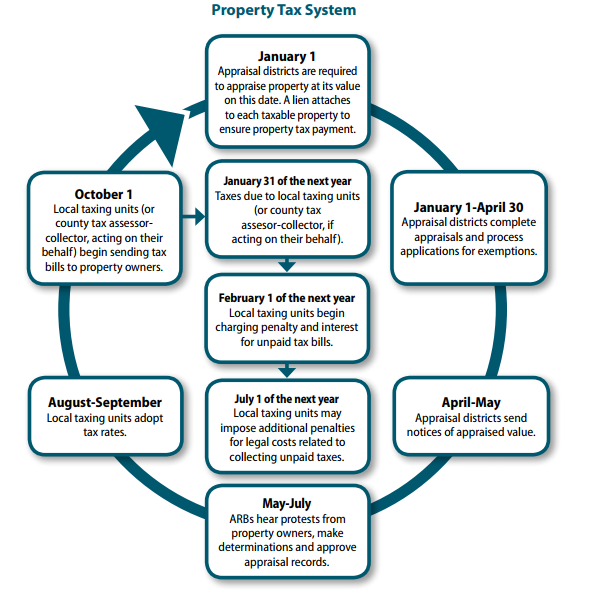

Within this site you will find general information about the District and the ad valorem property tax system in Texas, as well as information regarding specific properties within the district.

Property Tax System

Delta Appraisal District Taxing Entities

2025 Taxing Rates |

|

| Delta County | 0.49201300 |

| Delta R&B | 0.10208400 |

| Delta CO EMSD #1 | 0.02968600 |

| Delta MUD | 0.09201200 |

| City of Cooper | 0.64245900 |

| City of Pecan Gap | 0.07572800 |

| Chisum ISD | 1.08940000 |

| Commerce ISD | 1.23750000 |

| Cooper ISD | 0.75750000 |

| Cooper ISD I&S | 0.16000000 |

| Fannindel ISD | 0.79520000 |